gymnasium35.ru Overview

Overview

Tuition Assistance Certificate Programs

Does TA pay for certificate programs. Date updated ; Rating. Categories; Tuition Assistance (TA). Does TA pay for certificate programs? Check out our NEW Program Upgrades · Have completed Basic Training (or its equivalent) · Attending an accredited Texas college or university · Pursuing: an. The Department of Defense (DoD) Tuition Assistance (TA) program provides financial assistance to Service members for voluntary off-duty education programs. You can submit TA applications up to 90 days from the class start date, but no later than seven days prior to the course start date. Apply for TA at MyCG Ed. The Army's Tuition Assistance program helps Soldiers in active duty, the Army Reserve, or the Army National Guard with up to $4, annually towards school or. Established in , the Tuition Assistance Grant Program (VTAG) is designed to assist Virginia residents who attend accredited private, nonprofit colleges and. It has to be a degree program approved by the education office. That's where “approved” comes in. The education office will look at your. TA is available for courses that are offered in the classroom or by distance learning and is part of an approved academic degree or certificate program. The. The Military Tuition Assistance (TA) program is an important quality of life program that provides tuition for college courses taken by active duty personnel. Does TA pay for certificate programs. Date updated ; Rating. Categories; Tuition Assistance (TA). Does TA pay for certificate programs? Check out our NEW Program Upgrades · Have completed Basic Training (or its equivalent) · Attending an accredited Texas college or university · Pursuing: an. The Department of Defense (DoD) Tuition Assistance (TA) program provides financial assistance to Service members for voluntary off-duty education programs. You can submit TA applications up to 90 days from the class start date, but no later than seven days prior to the course start date. Apply for TA at MyCG Ed. The Army's Tuition Assistance program helps Soldiers in active duty, the Army Reserve, or the Army National Guard with up to $4, annually towards school or. Established in , the Tuition Assistance Grant Program (VTAG) is designed to assist Virginia residents who attend accredited private, nonprofit colleges and. It has to be a degree program approved by the education office. That's where “approved” comes in. The education office will look at your. TA is available for courses that are offered in the classroom or by distance learning and is part of an approved academic degree or certificate program. The. The Military Tuition Assistance (TA) program is an important quality of life program that provides tuition for college courses taken by active duty personnel.

The Army Credentialing Assistance (CA) Program helps pay for the courses and exams you'll need to take to earn certain industry-recognized certifications. Service members, veterans, and their families may be able to get help paying for college or training programs. I currently work with a company that offers a yearly tuition reimbursement ($) and I'm wondering where some of you would use it? The program is available for courses that are offered in the classroom or by distance learning and is part of an approved academic degree or certificate program. Navy TA pays for percent of tuition costs for courses applicable to the completion of a high school diploma or equivalency certificate. For other education. These programs help our veterans and active duty military obtain the financial means to pay for college, earn their high school GED, or complete a certificate. On This Page. Tuition Assistance; The Post-9/11 GI Bill; College Fund Programs; Loan Repayment Programs. FTA is financial assistance provided for voluntary off-duty education programs in support of a Soldier's professional and personal self-development goals. If you have completed Advanced Individual Training (AIT), Warrant Officer Basic Course (WOBC) or Basic Officer Leadership Course (BOLC), you could be eligible. The Gap Tuition Assistance Program was established as part of the Skilled Worker and Job Creation Fund to provide funding to community colleges for tuition. The Undergraduate Certificate is highly recommended program for active military servicemembers. This credit program can be completed on a full-time schedule. Degree and Credit-Bearing Certificate Programs: Tuition Assistance (TA) · Full time – $4, per semester/ $8, per calendar year · Full time – $2, per. Veterans Affairs Information: You can use your VA education benefits on + eCornell certificates and courses. To enroll using VA benefits, request more. On This Page. Tuition Assistance; The Post-9/11 GI Bill; College Fund Programs; Loan Repayment Programs. You can also use TA to take college courses that are cert-focused. That is to say, your tuition covers the training for the test and then the. The student is financially responsible for any tuition costs incurred without an approved TA voucher in hand. Failure to pass a course with a "C" or higher for. The obligation begins on the final day of the last course using TA. The term of service obligation is (2) years for AD Officers and (4) years for SELRES. Combining Benefits. Soldiers may use FTA and MGIB-SR (Chapter ) benefits during the same semester and use FTA and for the same course. Student aid often comes in the form of loans, but when looking for money for certificate programs, grants should never be overlooked. The largest federally. The Certified Engineering Assistant program provides students with the necessary training, through a series of courses, for a career as a certified engineer.

Can You Transfer Credit Card Balances

A balance transfer is when you move the balance from one credit or store card to another credit card with a different provider, usually to take advantage of a. A balance transfer lets you move a balance from an existing credit or store card to another card with a different provider. · With all of your borrowing in one. A balance transfer can give you the flexibility to: Pay off high-interest balances; Fund large expenses, such as home improvements; Cover emergencies and other. With a Wells Fargo balance transfer credit card, you can pay off higher interest rate balances, cover planned or unexpected expenses, and simplify your. Move debt from one of your credit cards at another financial institution to your TD credit card. Learn more about our balance transfer credit card options. A credit card balance transfer is a transfer of a balance from one credit card account to another. You may wish to transfer, for example, a balance from a high-. A balance transfer involves moving the debt from one or more credit card accounts to a different credit card. This way, you can focus on what you still owe. Balance transfers can also simplify bills by consolidating several balances with different creditors onto one card with one payment. Say you have a credit card. Choose from your Chase cards to see if you have eligible balance transfer offers. Enter amount. Select an offer, then enter the amount and the credit card to. A balance transfer is when you move the balance from one credit or store card to another credit card with a different provider, usually to take advantage of a. A balance transfer lets you move a balance from an existing credit or store card to another card with a different provider. · With all of your borrowing in one. A balance transfer can give you the flexibility to: Pay off high-interest balances; Fund large expenses, such as home improvements; Cover emergencies and other. With a Wells Fargo balance transfer credit card, you can pay off higher interest rate balances, cover planned or unexpected expenses, and simplify your. Move debt from one of your credit cards at another financial institution to your TD credit card. Learn more about our balance transfer credit card options. A credit card balance transfer is a transfer of a balance from one credit card account to another. You may wish to transfer, for example, a balance from a high-. A balance transfer involves moving the debt from one or more credit card accounts to a different credit card. This way, you can focus on what you still owe. Balance transfers can also simplify bills by consolidating several balances with different creditors onto one card with one payment. Say you have a credit card. Choose from your Chase cards to see if you have eligible balance transfer offers. Enter amount. Select an offer, then enter the amount and the credit card to.

Credit card balance transfers allow you to move debt from an existing credit card account to a new card at a lower interest rate. Yes, you can make a partial balance transfer if the transfer card's credit limit is less than the amount you're planning to transfer. When you transfer a. Select your credit card. · Online banking: Choose Account services, then select Balance transfer from the "Payments" section. · Review the offers shown; when you. Simply put, it's a credit card that allows you to transfer in a balance from another card, typically at a low introductory APR. You may pay a balance transfer. Discover balance transfer credit card offers can help you pay off credit card balances with a low-intro APR balance transfer. Make a balance transfer to save money on interest and get closer to being debt-free. Learn how much you can save by transferring a balance to a BMO credit card. Credit card balance transfers work by directly paying off the balances you have with other creditors using available credit. Rather than receiving a lump sum of. You may typically request a balance transfer for a new or existing Capital One credit card online or over the phone. You may need to provide some information. A balance transfer allows you to take existing balances from one or more credit card accounts and transfer that debt to a new credit card with a lower interest. Move your debt to a balance transfer card that offers no interest for up to 20 months, you can save a large chunk of money and pay off your credit card faster. A balance transfer credit card could offer you a chance to pay less interest you can consolidate credit card debt and manage your monthly finances more easily. CK Editors' Tips††: Balance transfer credit cards allow you to move your existing credit card debt to a new card, where you can pay it off with a lower. Here are 10 steps on how to transfer a credit card balance from an old card to a new one with a lower rate. A balance transfer is when you shift debt from one (or many) cards to another card. Typically, you would transfer to a credit card with a lower interest rate. Balance transfers will hurt your credit score if you make a habit of opening new credit cards and repeatedly transferring balances between them. This approach. You can transfer balances between cards, but there is almost always a 3 or 4% fee attached to the balance transfer. There is no situation where. Basically, a balance transfer is when you repay the money you owe on one credit card with a new lower-interest rate credit card. While transferring your balance. Balance transfers can be a great strategy to lower your current credit card interest rate. · You can transfer your balance to an existing card or a new one—but. A credit card balance transfer is the process of moving your balance from a high-interest credit card to a new credit card with a lower interest rate. Yes, you can make a partial balance transfer if the transfer card's credit limit is less than the amount you're planning to transfer. When you transfer a.

Venmo Stealing Money

It's no surprise that they've started using payment apps like CashApp, Venmo, and Zelle to trick you out of your money. Venmo scams, Zelle fraud, and other. Impersonating your financial institution, a fraud department, merchant or legitimate business · Funds being sent from your account without your knowledge. Scammers use common “get rich quick” schemes on Venmo to try and steal your money. In this scam, a fraudster — either a stranger or someone you know — asks you. Criminals' accounts usually use stolen funds that the P2P payment service will eventually flag as fraud. If you send money back to the scammer, the P2P service. Mobile payment apps like Venmo, Cash App and Zelle® make it easy to send Those credentials give them free reign to steal your money. No one other. 1. Phishing · 2. Identity Theft · 3. Romance Scams · 4. The 'Accidental' Money Transfer · 5. Smishing. What To Do if You Sent Money to a Scammer · Cash App. Cash App recommends chatting through their app for the fastest service. · Venmo. Venmo recommends chatting. If you have filed a fraud report with law enforcement, forward a copy of the report to Venmo and state you are not responsible for the money and you are the. Before sending money to the seller, scammers may steal someone's Venmo account details and then funnel the money over to their own account. When that person. It's no surprise that they've started using payment apps like CashApp, Venmo, and Zelle to trick you out of your money. Venmo scams, Zelle fraud, and other. Impersonating your financial institution, a fraud department, merchant or legitimate business · Funds being sent from your account without your knowledge. Scammers use common “get rich quick” schemes on Venmo to try and steal your money. In this scam, a fraudster — either a stranger or someone you know — asks you. Criminals' accounts usually use stolen funds that the P2P payment service will eventually flag as fraud. If you send money back to the scammer, the P2P service. Mobile payment apps like Venmo, Cash App and Zelle® make it easy to send Those credentials give them free reign to steal your money. No one other. 1. Phishing · 2. Identity Theft · 3. Romance Scams · 4. The 'Accidental' Money Transfer · 5. Smishing. What To Do if You Sent Money to a Scammer · Cash App. Cash App recommends chatting through their app for the fastest service. · Venmo. Venmo recommends chatting. If you have filed a fraud report with law enforcement, forward a copy of the report to Venmo and state you are not responsible for the money and you are the. Before sending money to the seller, scammers may steal someone's Venmo account details and then funnel the money over to their own account. When that person.

SCAM ALERT: Got a Venmo, PayPal, Zelle or Cash App account? Crooks are wiping out bank accounts through these payment apps, but money expert. They'll capture your login credentials to hack your Venmo account and steal your funds, or your personal information to commit identity theft. How to avoid. Because you did NOT authorize a payment, you are typically able to get your money back after reporting the incident. how to avoid payment fraud. SCAM. If you. Send money · Request money · Donate and raise funds · Start selling. Manage Your Accept Venmo · Payment Methods · In-Person Payments. Risk & Operations. Fraud. 8. Freeze your credit. Some Venmo scams steal more than money — scammers may have your sensitive financial information as well. If this is the case, fraudsters. Peer-to-peer payment (P2P) platforms such as Zelle, Venmo, Cash App and PayPal have made it simple for people to quickly transfer money to each other and to. Common Questions about Scams and Fraudsters · Tap the profile icon in the top right corner · Tap Support · Select Report a Payment Issue · Select the payment and. Serving as a money mule can also damage your credit and financial standing. Additionally, you risk having your own personally identifiable information stolen. Venmo scams are currently the most common payment app scams reported to Hiya. In addition to reports by users, Hiya also identifies current scams through its. One common scheme involves scammers connecting stolen credit cards to Venmo, using the card to transfer the money to a random user and then reaching out to that. Just know that scammers can use Venmo to steal your items. But what you don't know is that the scammer funded their Venmoaccount with either. You might be asked to click a link to confirm your personal and financial information — and you might be told you must do it urgently. It's another form of a. In case of stolen funds, the fraudulent transfer will ultimately be removed from your account, and it”s important to remember that most digital wallet providers. But you're probably familiar with names such as Zelle®, PayPal®, Venmo, and Cash App. P2P apps are, by and large, very safe. But like any payment method. After you have wired the money you'll find out that the order was made with a stolen card or bank account. You may be held liable for returning the funds to the. In this multi-step scam, evildoers connect stolen credit cards to Venmo and use them to transfer money to random people “by accident”. Then, they ask for the. Unfortunately, whenever money is involved, so are scammers. They'll do anything to steal a quick buck. Typically, scammers do most of their. VENMO SCAM ALERT! Be very careful if a money on @venmo and then asks for it back. It could be an elaborate scam to steal your cash. Technically they can but as a rule they won't. I for instance only use PayPal to make payments at sites where there is no other option. Scammers often use sophisticated tactics to commit fraud that make it hard to cancel or reverse the transaction. If you send money to a scammer, you may not be.

What Taxes Do You Pay On Stocks

The current capital gains tax rates are generally 0%, 15% and 20%, depending on your income. Even a 20% tax “may be a small price to pay for success,” says Joe. Capital gains tax is a tax on the profit that an investor realizes when they sell an investment for more than they paid for it. In the US, capital gains tax is. You'll pay taxes on your ordinary income first and then pay a 0% capital gains rate on the first $33, in gains because that portion of your total income is. Stock Sale Planning If you are selling your company's stock, the gain will generally be taxed at preferential capital gains tax rates. Additional. To lower your tax rate on income, consider owning investments that pay qualified dividends. These dividends are federally taxable at the capital gains rate. Capital gains are generally included in taxable income, but in most cases, are taxed at a lower rate. A capital gain is realized when a capital asset is sold or. At the federal level, capital gains are taxed based on the several factors including the type of asset, how long you held the asset, and your overall income. Only individuals owing capital gains tax are required to file a capital gains tax return, along with a copy of their federal tax return for the same taxable. Any time you sell an investment for more than you bought it, you potentially create a taxable capital gain. Capital gains can apply to almost any investment. The current capital gains tax rates are generally 0%, 15% and 20%, depending on your income. Even a 20% tax “may be a small price to pay for success,” says Joe. Capital gains tax is a tax on the profit that an investor realizes when they sell an investment for more than they paid for it. In the US, capital gains tax is. You'll pay taxes on your ordinary income first and then pay a 0% capital gains rate on the first $33, in gains because that portion of your total income is. Stock Sale Planning If you are selling your company's stock, the gain will generally be taxed at preferential capital gains tax rates. Additional. To lower your tax rate on income, consider owning investments that pay qualified dividends. These dividends are federally taxable at the capital gains rate. Capital gains are generally included in taxable income, but in most cases, are taxed at a lower rate. A capital gain is realized when a capital asset is sold or. At the federal level, capital gains are taxed based on the several factors including the type of asset, how long you held the asset, and your overall income. Only individuals owing capital gains tax are required to file a capital gains tax return, along with a copy of their federal tax return for the same taxable. Any time you sell an investment for more than you bought it, you potentially create a taxable capital gain. Capital gains can apply to almost any investment.

The current capital gains tax rates are generally 0%, 15% and 20%, depending on your income.

But for general investing accounts, taxes are due at the time you earn the money. The tax rate you pay on your investment income depends on how you earn the. Taxable income: Long-term capital gains and qualified dividends are generally taxed at special capital gains tax rates of 0%, 15%, and 20% depending on your. An individual's net capital gains are taxed at the rate of 7%. Dividends and interest income are taxed at a rate based on Connecticut Adjusted Gross Income. The. Remember: dividends from shares held in a stocks and shares Isa or pension are tax-free. You do not need to tell HMRC if your dividends are within the allowance. or has a tax treaty with the U.S. In addition, you must own the stock for a specific period of time. They are taxed at 0%, 15%, and 20%. How to file with stock investment income Add the information from the B you received from your brokerage into FreeTaxUSA. After your stock sales are. Yes. Cash App Investing is required by law to file a copy of the Form Composite Form to the IRS for the applicable tax year. How do I. Key Takeaways · Capital assets include stocks, bonds, precious metals, jewelry, art, and real estate. · Short-term capital gains are taxed as ordinary income;. You have a taxable gain when you sell a capital asset—such as shares of a publicly traded company on a stock exchange—for more than your total cost basis (what. Short-term capital gains are taxed at the investor's ordinary income tax rate and are defined as investments held for a year or less before being sold. Long-. Meanwhile, long-term gains are taxed at either 0%, 15%, or 20%. The rate you pay is based on your taxable income. Just like with ordinary income tax rates, the. Depending on your income level, and how long you held the asset, your capital gain on your investment income will be taxed federally between 0% to 37%. When you. Everyone has to pay taxes on stock gains, as well as returns on other kinds of investments (AKA the capital gains tax). Heres an introduction into capital gains. You may have to pay Capital Gains Tax if you make a profit ('gain') when you sell (or 'dispose of') shares or other investments. Shares and investments you. Investments in Stocks and Bonds. Any gain or loss on the sale, exchange or disposition of stocks or bonds is reportable for Pennsylvania personal income tax. In , a married couple filing jointly with taxable income of up to $80, pays nothing in long-term capital gains. Those with incomes from $80, to. 1, , you do not owe Washington's capital gains tax on any of the payments you receive. Do I owe capital gains tax on a sale of cryptocurrency? You will. Ordinary income, including interest payments on bonds and cash, is currently taxed at individual rates as high as 37%. Profits from the sale of stocks you've. In addition, if you sell a stock, you pay 15% (20% for high earners) of any profits you made over the time you held the stock. Those profits are known as. They're subject to a 0%, 15%, or 20% tax rate, depending on your level of taxable income. Short-term capital gains are gains on investments you owned 1 year or.

Oil And Gas Index Fund

Integrated Oil & Gas%. Top Country. AS OF 07/31/ United States% Read the fund's prospectus for more detailed information about the fund. The Fund seeks to track the performance of an index composed of companies from the European Oil & Gas sector. List of Top Performing Oil & Gas ETFs in ; USO · United States Oil Fund, % ; BNO · United States Brent Oil Fund, % ; OILK · ProShares K-1 Free Crude. Gas Index. The Fund's returns may not match due to expenses incurred by the Fund or lack of precise correlation with the index. Tracking Error Risk. As with. Fund. Oil & Gas Exploration & Production. Integrated Oil & Gas. Oil & Gas Drilling. Oil & Gas Equipment & Services. Cash and/or. Index returns do not represent Fund returns. An investor cannot invest servicing energy related products, including oil and gas exploration and. Vanguard Index Fund VFINX has $ BILLION invested in fossil fuels, % of the fund. While the Fund has a daily investment objective, you may hold Fund shares The Index is one of eleven S&P Select Sector Indices, each designed to. The SPDR® S&P® Oil & Gas Exploration & Production ETF seeks to provide investment results that, before fees and expenses, correspond generally to the total. Integrated Oil & Gas%. Top Country. AS OF 07/31/ United States% Read the fund's prospectus for more detailed information about the fund. The Fund seeks to track the performance of an index composed of companies from the European Oil & Gas sector. List of Top Performing Oil & Gas ETFs in ; USO · United States Oil Fund, % ; BNO · United States Brent Oil Fund, % ; OILK · ProShares K-1 Free Crude. Gas Index. The Fund's returns may not match due to expenses incurred by the Fund or lack of precise correlation with the index. Tracking Error Risk. As with. Fund. Oil & Gas Exploration & Production. Integrated Oil & Gas. Oil & Gas Drilling. Oil & Gas Equipment & Services. Cash and/or. Index returns do not represent Fund returns. An investor cannot invest servicing energy related products, including oil and gas exploration and. Vanguard Index Fund VFINX has $ BILLION invested in fossil fuels, % of the fund. While the Fund has a daily investment objective, you may hold Fund shares The Index is one of eleven S&P Select Sector Indices, each designed to. The SPDR® S&P® Oil & Gas Exploration & Production ETF seeks to provide investment results that, before fees and expenses, correspond generally to the total.

Oil USO | United States Oil Fund USL | United States 12 Month Oil Fund BNO Index Fund EXCHANGE TRADED FUNDS PRODUCTS / Exchange Traded Funds. oil, and natural gas. The fund's main risk is its narrow scope—it invests solely in energy stocks. An investor should expect high volatility from the fund. Search for Stocks, ETFs or Mutual Funds. Search. Please enter a valid Stock, ETF, Mutual Fund, or index symbol. SPDR® S&P Oil & Gas Exploration & Production. Why Invest. Exposure to companies that should benefit from the growing demand for natural gas; Index-based investment methodology; Gas utility stocks may. Includes stocks of companies involved in the exploration and production of energy products such as oil, natural gas, and coal. The fund's target index may, at. Fund Manager · ICICI Prudential Nifty50 Value 20 Index Fund - since Jan | Invest Now · BHARAT 22 ETF - since Feb | Invest Now · ICICI Prudential BHARAT. Gas Fund Gasoline UGA | United States Gasoline Fund Metals CPER | United States Copper Index Fund EXCHANGE TRADED FUNDS PRODUCTS / Exchange Traded Funds. 1 Yr. Since Inception. NAV. Closing Market Price. Alerian Texas Weighted Oil and Gas Index (Underlying Index). Fund Management. Investment Adviser: Texas. Oil/gas industry. Oil/gas producers and refiners, oil field services and equipment companies, pipeline operators. holdings. $B. Oil & Gas Exploration &. Production Select Industry Index, the fund employs a sampling strategy. It generally invests substantially all, but at least 80%, of. The index is designed to measure the stock performance of U.S. companies in the oil and gas sector. Here are the best Equity Energy funds · The Energy Select Sector SPDR® ETF · Vanguard Energy ETF · Fidelity MSCI Energy ETF · iShares US Energy ETF · iShares US Oil. Funds to Buy · Home · investing · ETFs. 8 Best Energy ETFs to Buy. Oil and gas stocks are off to a solid start in and these energy ETFs can give investors. The index is an economic-value weighted index providing exposure to companies that extract oil and gas within Texas. The fund is non-diversified. Additional. DWCOGS | A complete Dow Jones U.S. Oil & Gas Total Stock Market Index index overview by MarketWatch. View stock market news, stock market data and trading. S&P Select Industry Indices are designed to measure the performance of narrow GICS® sub-industries. The S&P Oil & Gas Exploration & Production Select. The Index measures the performance of the oil exploration and production sub-sector of the U.S. equity market. IEO Fund details. Fund Family, BlackRock Funds. Energy: oil and gas · Precious metals: gold, silver and platinum; Industrial BNPP RICI Enhanced Brent Crude Oil (ER) Index EUR Hedge ETCDEPZ9REB6, 4. The index measures the performance of the energy sector of the U.S. equity market. ETFs Tracking Other Mutual Funds. Mutual Fund to ETF Converter Tool. We're. Get detailed information on the DJ Oil & Gas including charts, technical analysis, components and more.

What Are The Best Etfs To Buy Right Now

For more on the Zacks ETF Rank, see the Zacks ETF Rank Guide. Trending topics. Latest; Most Popular. Best Momentum Stocks to Buy for September 6th · Weekly. Top 25 ETFs ; 1, SPY · SPDR S&P ETF Trust ; 2, IVV · iShares Core S&P ETF ; 3, VOO · Vanguard S&P ETF ; 4, VTI · Vanguard Total Stock Market ETF. The best ETFs by 1-year return include SPMO and ITB. Learn more about their pros and cons here and see lists of the best-performing ETFs in various. The first fund on this list is the SPDR Portfolio S&P ETF (SPLG), and it's as simple as it gets. This State Street Global Advisors index fund simply tracks. Symbol, Company, Zacks ETF Rank, Current price, 3 Mos. 6 Mos. 1 Yr. Report. If you aren't seeing your favorite ETF in the above list, then we do not have a. Performance of ETFs ; Schemes, Latest Price, % Change ; CPSE Exchange Traded Fund, , ; Motilal Oswal NASDAQ ETF, , ; SBI - ETF Nifty Next. VUG, VGT, MGK, SFY, XSD, VTI, if you're using Robinhood or any other platform. Most of aforementioned ETFs overlap. They have the best growth. Invests in the underlying assets of the index directly to best track the index. These are the most common types of ETFs. Does not invest in assets directly. Our recommendation for the best overall growth ETF is IUSG. This ETF offers a combination of a low expense ratio, low turnover, strong growth metrics and. For more on the Zacks ETF Rank, see the Zacks ETF Rank Guide. Trending topics. Latest; Most Popular. Best Momentum Stocks to Buy for September 6th · Weekly. Top 25 ETFs ; 1, SPY · SPDR S&P ETF Trust ; 2, IVV · iShares Core S&P ETF ; 3, VOO · Vanguard S&P ETF ; 4, VTI · Vanguard Total Stock Market ETF. The best ETFs by 1-year return include SPMO and ITB. Learn more about their pros and cons here and see lists of the best-performing ETFs in various. The first fund on this list is the SPDR Portfolio S&P ETF (SPLG), and it's as simple as it gets. This State Street Global Advisors index fund simply tracks. Symbol, Company, Zacks ETF Rank, Current price, 3 Mos. 6 Mos. 1 Yr. Report. If you aren't seeing your favorite ETF in the above list, then we do not have a. Performance of ETFs ; Schemes, Latest Price, % Change ; CPSE Exchange Traded Fund, , ; Motilal Oswal NASDAQ ETF, , ; SBI - ETF Nifty Next. VUG, VGT, MGK, SFY, XSD, VTI, if you're using Robinhood or any other platform. Most of aforementioned ETFs overlap. They have the best growth. Invests in the underlying assets of the index directly to best track the index. These are the most common types of ETFs. Does not invest in assets directly. Our recommendation for the best overall growth ETF is IUSG. This ETF offers a combination of a low expense ratio, low turnover, strong growth metrics and.

Top 10 most-popular ETFs in August ; 2, Vanguard S&P UCITS ETF GBP (LSE:VUSA), No change ; 3, Invesco EQQQ NASDAQ ETF GBP (LSE:EQQQ), Up one ; 4. Related Tickers ; VOO, Vanguard Index Fund, % ; BND, Vanguard Total Bond Market ETF, % ; QQQ, Invesco QQQ Trust, % ; IVV, iShares Core S&P ETF. ETFs ; SQQQ ProShares UltraPro Short QQQ. ; SOXL Direxion Daily Semiconductor Bull 3X Shares. ; SOXS Direxion Daily Semiconductor Bear 3X Shares. Stock Market Crash - How You Can Prepare RIGHT NOW! · 8 Best Monthly Dividend ETFs | ETF Investing in Canada · 7 Best High Growth ETFs for | ETF. Top 25 ETFs ; 1, SPY · SPDR S&P ETF Trust ; 2, IVV · iShares Core S&P ETF ; 3, VOO · Vanguard S&P ETF ; 4, VTI · Vanguard Total Stock Market ETF. Best ETFs · SPDR S&P ETF Trust (SPY) · iShares Core S&P ETF (IVV) · Vanguard S&P ETF (VOO) · Vanguard Total Stock Market ETF (VTI) · Vanguard FTSE. 1. Invesco QQQ (QQQ) · 2. iShares Russell Growth ETF (IWF) · 3. Vanguard Growth ETF (VUG). Stock Market Crash - How You Can Prepare RIGHT NOW! · 8 Best Monthly Dividend ETFs | ETF Investing in Canada · 7 Best High Growth ETFs for. This is a list of all Aggressive Growth ETFs traded in the USA which are currently tagged by ETF Database. ETF in a single “best fit” category. The 7 Best Inverse ETFs · Direxion Daily S&P Bear 3X (SPXS) · Proshares Short 20+ Year Treasury (TBF) · Proshares Short High Yield (SJB) · Proshares Short MSCI. ETFs ; EEM iShares MSCI Emerging Markets ETF. (%). , %, M ; TZA Direxion Daily Small Cap Bear 3X Shares. + (+%). +. In this curated investment guide, you will find all ETFs that allow you to invest broadly diversified in stocks worldwide. Currently, there are 12 ETFs. With so many ETFs on the market today, and more launching every year, it can be tough to determine which product will work best in your portfolio. How should. SPDR S&P ETF Trust (SPY) is the best-recognized and oldest US-listed ETF and typically tops rankings for largest AUM and greatest trading volume. The fund. Reality Shares DIVCON Dividend Defender ETF might be the most complex option among these best ETFs for a bear market, but it has delivered in good times and bad. The biggest ETF providers are BlackRock (iShares), Vanguard, State Street (SPDR), and Invesco. Other big ones include Schwab, WisdomTree, and Van Eck Associates. I think some of the best and most innovative ETFs right now are: * Strategy Shares Gold-Hedged Bond ETF (GLDB) this ETF combines corporate. Vanguard S&P ETF (VOO), percent, percent ; SPDR S&P ETF Trust (SPY), percent, percent ; iShares Core S&P ETF (IVV), percent. The SPDR S&P Telecom ETF invests in companies within the telecommunications industry, including wireless services and communication equipment. · GOVZ seeks to. SPDR S&P ETF Trust will focus more on high-cap stocks, while Vanguard Growth Index Fund will give you exposure to low-cap stocks. Other ETFs.

Define Short Sale In Real Estate

Recent economic challenges have resulted in a proliferation of short sales and the need for real estate and mortgage professionals to provide competent. A short sale is really a form of pre-foreclosure sale and occurs when the mortgagee agrees to accept less than the loan amount to avoid foreclosure. A. A short sale is a pre-foreclosure residential real estate transaction where the owner of the mortgage loan, the lender or lien holder (hereinafter sometimes ". BASIC SHORT SALE QUESTIONS Here are questions most homeowners ask about a short sale. 1. What is a real estate short sale? A real estate short sale is a. Short Sale – A “short sale” occurs when a property is sold and the lender agrees to accept a discounted payoff of the loan. This means that the lender will. A short sale is when a property is priced lower than the financing owed on the property and the lien holder, typically a bank, is willing to allow the sale to. A short sale in real estate takes place when the lender (e.g., bank, Mortgage Company) agrees to accept less than the remaining balance on the mortgage owed. Listing the Property and Evaluating a Short Sale · is already listed with a real estate agent. must ask the borrower to provide the real estate agent's name. Short sale in real estate refers to a sale of a house when the sale price is less than the outstanding mortgage on the property. Short sales occur when. Recent economic challenges have resulted in a proliferation of short sales and the need for real estate and mortgage professionals to provide competent. A short sale is really a form of pre-foreclosure sale and occurs when the mortgagee agrees to accept less than the loan amount to avoid foreclosure. A. A short sale is a pre-foreclosure residential real estate transaction where the owner of the mortgage loan, the lender or lien holder (hereinafter sometimes ". BASIC SHORT SALE QUESTIONS Here are questions most homeowners ask about a short sale. 1. What is a real estate short sale? A real estate short sale is a. Short Sale – A “short sale” occurs when a property is sold and the lender agrees to accept a discounted payoff of the loan. This means that the lender will. A short sale is when a property is priced lower than the financing owed on the property and the lien holder, typically a bank, is willing to allow the sale to. A short sale in real estate takes place when the lender (e.g., bank, Mortgage Company) agrees to accept less than the remaining balance on the mortgage owed. Listing the Property and Evaluating a Short Sale · is already listed with a real estate agent. must ask the borrower to provide the real estate agent's name. Short sale in real estate refers to a sale of a house when the sale price is less than the outstanding mortgage on the property. Short sales occur when.

This type of sale is often confused with a bank owned sale or a foreclosure, but it is neither. In a short sale, the homeowners still hold title to the property. In real estate, it means selling a house for less than the outstanding mortgage. In investing, a short sale is a strategy in which an investor takes a short. A short sale can occur when a home owner's debt on a property is greater than the amount for which the property can be sold. The result – lenders are sometimes. Real estate short sales are a form of disposition in which a homeowner sells their property for less than the remaining amount on their mortgage. These sales. A short sale in real estate takes place when the lender (e.g., bank, Mortgage Company) agrees to accept less than the remaining balance on the mortgage owed. of Processing Short Sales - Real Estate Continuing Education Classroom What Is a Short Sale; Hardship; Questions; Putting it Together; Qualifying. A bank-owned property is acquired by a financial institution when a homeowner defaults on their mortgage. These properties then sell at a discounted price, much. In real estate, a short sale is the sale of real estate in which the net proceeds are less than the mortgage owed or the total amount of lien debts that secure. Lets first define what a short sale is. It is when a bank decides to sell a property below the mortgage owned on it and accepts to take a loss in order to. Selling a home for less than the amount the current owner owes the mortgage company is called a short sale. For both buyers and sellers, the short sale. To understand what it means to buy a short sale home, we first need to define how a home falls into the short sale market. A short sale occurs when someone. If the auction fails to turn up a buyer willing to pay a price satisfactory to the lender, the home becomes Real Estate Owned (REO), where the owner is the bank. In a short sale, a borrower can sell the home and pay off a portion of the mortgage balance with the proceeds. To maximize the sales proceeds, the accepted home. A short sale generally involves the sale of a stock you do not own (or that you will borrow for delivery). Short sellers believe the price of the stock will. In other words after selling your home you will need to pay all the liens, realtor commissions, closing costs before you can transfer title to a new party. If. A short sale helps distressed homeowners avoid foreclosure and can provide good value for prospective buyers. Learn how the process works. A short sale is a real estate process whereby the homeowner can avoid having to weather the foreclosure process. Essentially, it is an agreed-upon arrangement. short sales are defined as a transaction where title transfers, where the often arise in a short-sale transaction and real estate professionals cannot. A short sale occurs when you sell stock you do not own Home · Introduction to Investing · Glossary. Main navigation (glossary). Save and Invest · Define Your. A quick sale is a real estate transaction in which the seller needs to sell their property quickly, usually within a short timeframe of a few weeks to a.

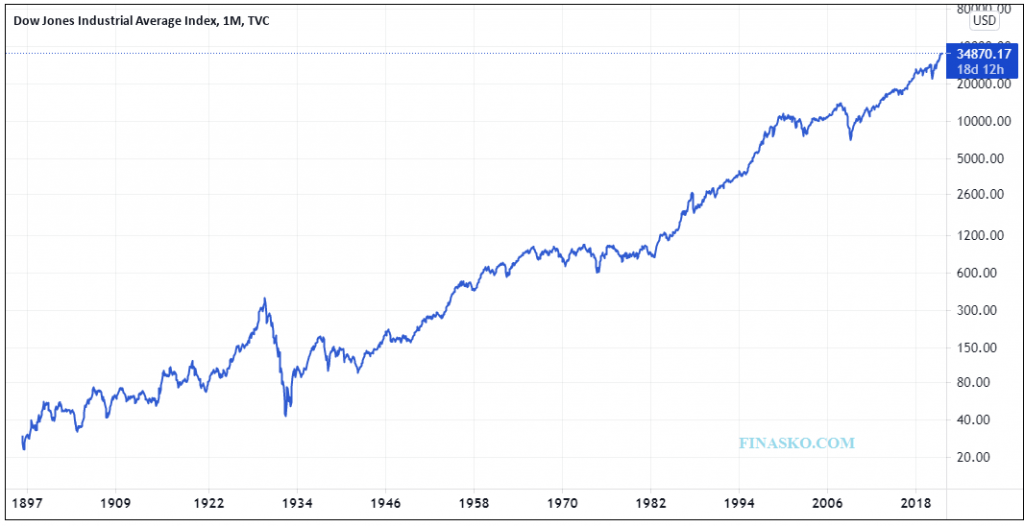

Djia Today Chart

Live Dow Jones data including quote, charts, news and analysis covering the Dow Jones Industrial Average (DJIA) in real time. Full ChartTakes you to an interactive chart which cannot interact. financial What every Canadian investor needs to know today. Yesterday. Traders. Key Data ; Open 41, ; Day Range 41, - 41, ; 52 Week Range 32, - 41, Get the latest Dow Jones Industrial Average .DJI) value, historical performance, charts, and other financial information to help you make more informed. Stock Market Today: Stocks edge higher after mixed jobs data. Stocks are set to extend their recent run of record highs Friday but face a key test with the. Chart. Area Chart. Renko. Column. Baseline. Line Break. Range. Kagi. Point And Figure Live educational sessions using site features to explore today's markets. View the full Dow Jones Industrial Average (DJIA) index overview including the latest stock market news, data and trading information. Register to attend complimentary webinars and deepen your knowledge of current trends and issues impacting the index universe today. IOSCO ESG Rating & Data. Dow Jones Industrial Average advanced index charts by MarketWatch. View real-time DJIA index data and compare to other exchanges and stocks. Live Dow Jones data including quote, charts, news and analysis covering the Dow Jones Industrial Average (DJIA) in real time. Full ChartTakes you to an interactive chart which cannot interact. financial What every Canadian investor needs to know today. Yesterday. Traders. Key Data ; Open 41, ; Day Range 41, - 41, ; 52 Week Range 32, - 41, Get the latest Dow Jones Industrial Average .DJI) value, historical performance, charts, and other financial information to help you make more informed. Stock Market Today: Stocks edge higher after mixed jobs data. Stocks are set to extend their recent run of record highs Friday but face a key test with the. Chart. Area Chart. Renko. Column. Baseline. Line Break. Range. Kagi. Point And Figure Live educational sessions using site features to explore today's markets. View the full Dow Jones Industrial Average (DJIA) index overview including the latest stock market news, data and trading information. Register to attend complimentary webinars and deepen your knowledge of current trends and issues impacting the index universe today. IOSCO ESG Rating & Data. Dow Jones Industrial Average advanced index charts by MarketWatch. View real-time DJIA index data and compare to other exchanges and stocks.

View live Dow Jones Industrial Average Index chart to track latest price changes. DJ:DJI trade ideas, forecasts and market news are at your disposal as. Index performance for Dow Jones Industrial Average (INDU) including value, chart, profile & other market data Get unlimited access today. Explore. Dow Jones 30 Index Live Chart, US 30 Real Time Chart, US30USD chart by TradingView, Dow Jones Industrial Average 30 Index Technical Analysis. Sign in or register now to start saving charts. FT predefined settings. Try these suggested chart setting presets. Short term. View. Medium term. View. Long. Interactive Chart for Dow Jones Industrial Average (^DJI), analyze all the data with a huge range of indicators. The Dow rises periodically through the decades with corrections along the way. Historical logarithmic graph of the DJIA from to Foundation, February. Track the latest stock market news happening on the Dow Jones today. Plus, get timely analysis of the DJIA and 30 Dow stocks. Up-to-date stock market data coverage from CNN. Get the latest updates on US markets, world markets, stock quotes, crypto, commodities and currencies. US Markets: Get the complete US Stock Markets coverage with latest news, analysis & research on Market Map, Charts, Key Statistics, Sector Performance. Dow Jones Today: Get all information on the Dow Jones Index including historical chart, news and constituents. A Complete Dow Jones Industrial Average overview by Barron's. View stock market news, stock market data and trading information. Dow Jones Industrial Average Index value has increased by % in the past week, since last month it has shown a % increase, and over the year it's. data closely watched by the Federal Reserve. The S&P rose 1%, the Nasdaq gained %, while the Dow Jones hit a new record close, adding points. Today's market ; NYSE COMPOSITE (DJ), 19,, (%) ; NYSE U.S. INDEX, 16,, (%) ; DOW JONES INDUSTRIAL AVERAGE, 41, Oops looks like chart could not be displayed! · Open41, · Day High41, · Day Low41, · Prev Close41, · 52 Week High41, · 52 Week High Date. Each point of the stock market graph is represented by the daily closing price for the DJIA. Historical data can be downloaded via the red button on the upper. Wall Street chart This market's chart. This is a visual representation of the price action in the market, over a certain period of time. You can use this to. Register to attend complimentary webinars and deepen your knowledge of current trends and issues impacting the index universe today. IOSCO ESG Rating & Data. Dow Jones Industrial Average | historical charts for DJIA to see performance over time with comparisons to other stock exchanges CMO Today · Logistics. Index performance for Dow Jones Industrial Average (INDU) including value, chart, profile & other market data Get unlimited access today. Explore.

How To Pay Bills On Time And Save Money

If you make a habit of depositing or moving money into your savings account every time you are paid, you may be less likely to spend it on your everyday. Make a list · Create bill-paying spaces · Check your statements · Review your due dates · Ask about your grace periods · Make a bill-paying date with yourself. It's overwhelming when you fall behind on paying bills. Take a look at these 6 strategies to help you pay bills if you've fallen behind. Credit card issuers will sometimes raise your interest rate if your payment is more than 60 days late, which would cost you money over time. If you set up. Schedule dates to pay bills - Set aside days of the month that you will sit down and pay bills. Add these dates in your calendar, scheduler or as phone. The snowball method doesn't aim to minimize interest or save money over time. Instead, it leverages the psychological benefits of paying off accounts to help. Whether you use paper or digital coupons, you can save even more money by “stacking” coupons and shopping at stores that have “double” or “triple” coupon days. Pay your bills on auto-pay. This ensures they are paid on time, in full to avoid late charges. As a bonus, some loan providers offer a small interest rate. Pay your bills on time · pay for regular bills monthly by Direct Debit · talk to the people you owe money to if you're struggling. If you make a habit of depositing or moving money into your savings account every time you are paid, you may be less likely to spend it on your everyday. Make a list · Create bill-paying spaces · Check your statements · Review your due dates · Ask about your grace periods · Make a bill-paying date with yourself. It's overwhelming when you fall behind on paying bills. Take a look at these 6 strategies to help you pay bills if you've fallen behind. Credit card issuers will sometimes raise your interest rate if your payment is more than 60 days late, which would cost you money over time. If you set up. Schedule dates to pay bills - Set aside days of the month that you will sit down and pay bills. Add these dates in your calendar, scheduler or as phone. The snowball method doesn't aim to minimize interest or save money over time. Instead, it leverages the psychological benefits of paying off accounts to help. Whether you use paper or digital coupons, you can save even more money by “stacking” coupons and shopping at stores that have “double” or “triple” coupon days. Pay your bills on auto-pay. This ensures they are paid on time, in full to avoid late charges. As a bonus, some loan providers offer a small interest rate. Pay your bills on time · pay for regular bills monthly by Direct Debit · talk to the people you owe money to if you're struggling.

Careful spending is where financial health begins. See how to help smooth out your spending habits, pay bills on time, and increase your ability to save. With no emergency savings to draw on during a crisis, you may have to rely on a high-interest credit card or a personal loan to cover the costs. To avoid. Schedule Bill-Paying Time. Carve out time on your calendar to pay bills on a regular basis in the same way that you schedule a time for the gym or work. It's overwhelming when you fall behind on paying bills. Take a look at these 6 strategies to help you pay bills if you've fallen behind. Schedule dates to pay bills - Set aside days of the month that you will sit down and pay bills. Add these dates in your calendar, scheduler or as phone. Pay your bills on time · pay for regular bills monthly by Direct Debit · talk to the people you owe money to if you're struggling. Continue to Pay a Loan or Bill: Make payments to savings or investment accounts with money that is freed up when loan payments end or an expense, such as. Even if you pay just a few days early, you can knock off some of those charges and save. When to make multiple payments on your credit card bill. If your. Set up an automatic bill pay with your bank. This is a pretty straightforward process. You'll offer up account information on each creditor to your bank, and. TIMELY BILLS: BILLS, BUDGET & EXPENSE TRACKER - ONE OF THE MOST COMPLETE BUDGETING APPS FREE. All in one money manager trusted by 1M+ users. Try using coupons and shopping on sale. Be sure everything you buy is necessary and cut back on just one or two things at a time to save money. ▷ Why is it important to pay your bills on time all the time? Page 6. By paying your bills on time, you: ▷ Avoid late fees and penalties- so you save money. Record your expenses · Include saving in your budget · Find ways to cut spending · Set savings goals · Determine your financial priorities · Pick the right tools. How to save money: 14 tips · 1. Set specific savings goals · 2. Create a monthly budget and stick to it · 3. Bring a shopping list to the store · 4. Try using cash. 1. Start tracking your spending and make a budget. · 2. Be a smart eater. · 3. Save on your power bill. · 4. Consolidate your debt and lower interest rate · 5. Step 1: Make all your minimum payments · Step 2: Build up a cash buffer · Step 3: Capture the full employer match · Step 4: Pay off any credit card debt · Step 5. The first thing you're going to need to do is to take stock of where you're at. First, take some time to figure out exactly how much debt you have. It sounds. Consider setting a savings goal and treat it as your last monthly "bill". All your other bills are paid up and you're looking at next month? 7 steps to start saving money: A comprehensive guide to saving, budgeting, and investing for a better financial future. TIMELY BILLS: BILLS, BUDGET & EXPENSE TRACKER - ONE OF THE MOST COMPLETE BUDGETING APPS FREE. All in one money manager trusted by 1M+ users.

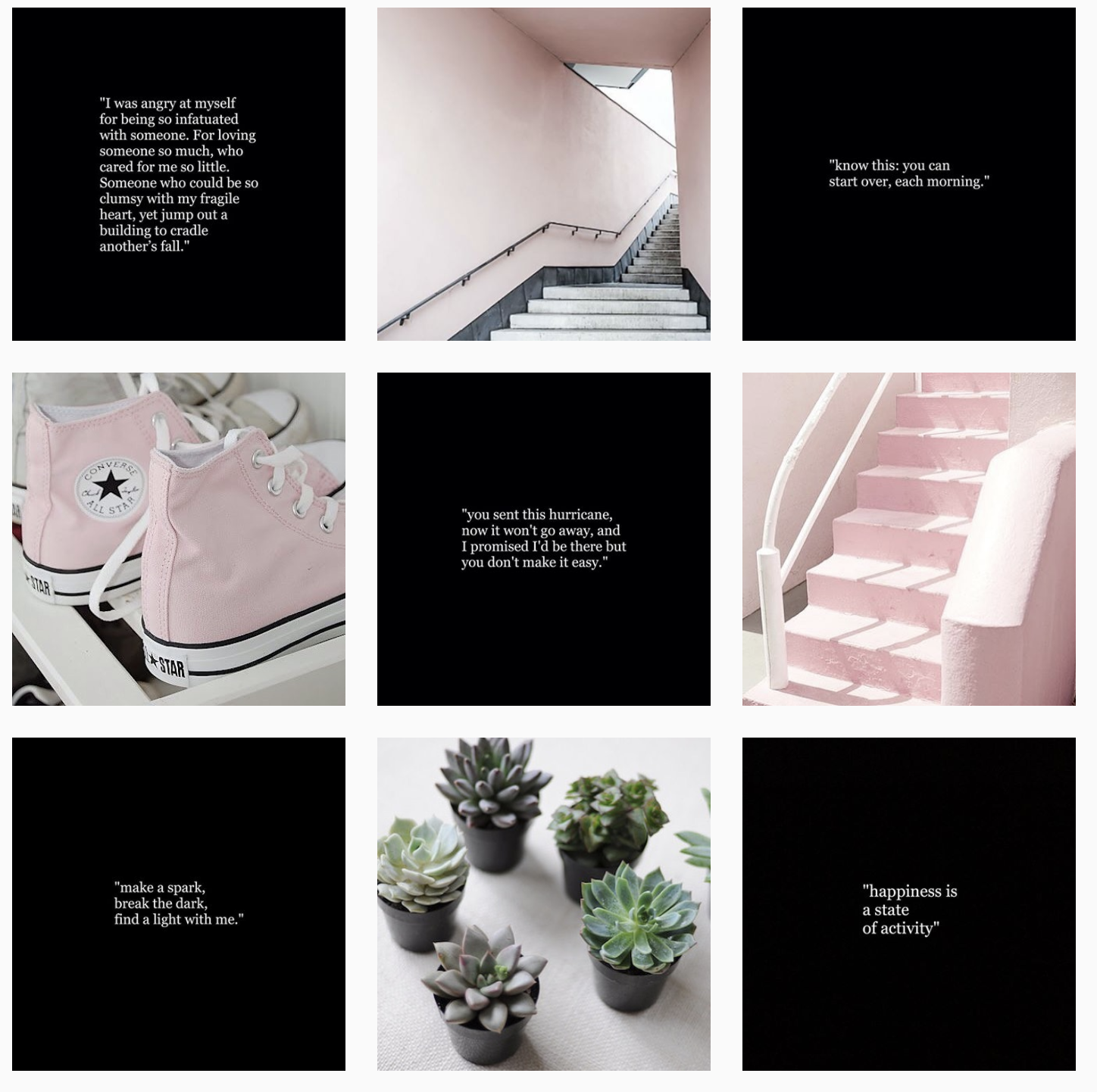

Instagram Grid Layout Planner

The Grid provides easy-to-use tools to plan and perfect your Instagram feed. Using our simple drag and drop editor, you can preview your images and videos. An Instagram Feed Planner helps you organize and visualize your upcoming posts to make your feed look its best. We've rounded up our top free apps for visually planning an eye-catching Instagram grid. gymnasium35.ru helps you create beautiful Instagram grids that capture attention and make a lasting impression. By planning your feed layout, you can ensure that. Start Scheduling Your Posts to Instagram Tailwind lets your quickly plan and schedule your grid with our 9-grid Preview Tool. You can drag and drop your posts. See how your upcoming posts will look with published content on your client's Instagram profile with Instagram Grid view. Organize your content — from posts to reels - and perfectly plan out your Instagram grid aesthetic when you use Later's visual Instagram Feed Planner. K Followers, Following, Posts - Your Instagram Feed Planner (@gymnasium35.ru) on Instagram: "❤️ Used by 10 Million Instagrammers ⭐️ Approved by. Preview is the ultimate Instagram feed planner app. Plan your: Photos, Videos, Carousels, Insta Stories, Reels, IGTVs. The Grid provides easy-to-use tools to plan and perfect your Instagram feed. Using our simple drag and drop editor, you can preview your images and videos. An Instagram Feed Planner helps you organize and visualize your upcoming posts to make your feed look its best. We've rounded up our top free apps for visually planning an eye-catching Instagram grid. gymnasium35.ru helps you create beautiful Instagram grids that capture attention and make a lasting impression. By planning your feed layout, you can ensure that. Start Scheduling Your Posts to Instagram Tailwind lets your quickly plan and schedule your grid with our 9-grid Preview Tool. You can drag and drop your posts. See how your upcoming posts will look with published content on your client's Instagram profile with Instagram Grid view. Organize your content — from posts to reels - and perfectly plan out your Instagram grid aesthetic when you use Later's visual Instagram Feed Planner. K Followers, Following, Posts - Your Instagram Feed Planner (@gymnasium35.ru) on Instagram: "❤️ Used by 10 Million Instagrammers ⭐️ Approved by. Preview is the ultimate Instagram feed planner app. Plan your: Photos, Videos, Carousels, Insta Stories, Reels, IGTVs.

Instagram PlannerTikTok PostingManage Social MediaSocial StrategySocial Reporting "UNUM has been what I've used to plan my Instagram for the last 4 years. Dokumen tersebut merupakan layout plan sebuah bangunan dengan skala yang menunjukkan tata letak ruang-ruang termasuk restoran dalam dan luar. layout. A 9-grid Instagram layout can stimulate users to scroll for more. Why Should I Plan My Instagram Feed? When a visitor lands on your profile, the. Dokumen tersebut merupakan layout plan sebuah bangunan dengan skala yang menunjukkan tata letak ruang-ruang termasuk restoran dalam dan luar. Free Social Media Scheduler! Visually plan your social media · Plann is designed for a visual-first experience to easily organize, design and publish your. For an easy-to-maintain Instagram grid, try filling the middle column (or row) with quotes while the rest of your grid contains photos. This grid layout creates. layout. A 9-grid Instagram layout can stimulate users to scroll for more. Why Should I Plan My Instagram Feed? When a visitor lands on your profile, the. Join 9 Million Instagrammers who use Preview Instagram Feed Planner app everyday: SCHEDULE + FILTERS + ANALYTICS + CAPTIONS + TRENDING HASHTAGS and more. This Classic grid layout is the most widely recognized format for organizing the Instagram feed. It's a simple 3×3 grid, meaning three rows and three columns. Instagram grid layout planner is the best tool to plan your posts. Engage your audience and make your content look stunning. Try it now! Plan your Instagram feed & schedule with Pallyy. Pallyy provides a grid planning view so that you can plan, create & schedule your posts all in the one place. Planner: plan your feed for Instagram and design your perfect IG profile Plan your photo, video, carousel content and much more with our grid planner! I also heard they're going to release or at least try a new feature where you can plan the feed directly from the instagram app when you upload. Instagram Grid Layout. Free Download: Instagram Grid Planner & Moodboard Template · An Illustrator . · A Photoshop . · Both files include a moodboarding area where you can store. Your go-to Instagram grid planner. Visually plan and auto-post your Instagram content - including Reels and Stories! Easily plan everything for Instagram. Instagram Planner · Version removes the Camera Roll and introduces an editable grid directly within the user interface. · Select a grid block and simply paste. Instagram grid layout planner is the best tool to plan your posts. Engage your audience and make your content look stunning. Try it now! To see the Instagram Grid Planner, navigate to Publishing > Instagram Grid Planner. This view shows sent posts, including Reels, for the past 90 days. If you're not a big planner or don't have time to invest in curating your feed, using the checkerboard layout with alternating quotes and photos is the easiest.